[ad_1]

Authentic estate buyers have utilised the Section 1031 exchange for decades to trade belongings though deferring taxable gains. On the other hand, the experienced option zone program supplies serious estate investors choices to defer taxes and, in some cases, even remove taxable profits completely, which has led actual estate traders to request: Which is much better, a 1031 tax trade or a skilled possibility zone true estate investment?

The IRS has founded stringent rules for each options, and some genuine estate investments may perhaps qualify for both of those tax breaks. Prior to selecting amongst the two methods, genuine estate traders should really understand how the distinctions have an affect on their taxable gains.

What Is a Certified Possibility Zone?

Communities in financial distress needing expense and revitalization are identified as “opportunity zones,” but a lot of houses inside of these districts have been through sizeable variations and are ripe for progress. As a outcome of the Tax Cuts and Jobs Act of 2017, prospect zones present tax incentives for investing in community growth in these places to encourage economic expansion and career generation.

Chance zones array from rural areas without the need of providers, to blighted neighborhoods, to areas that have expert financial redevelopment. The governors of every condition nominate a compact range of tracts that meet the requirements for formal designation as qualified chance zones (QOZs). Chance zones are selected and accredited by the Secretary of the U.S. Treasury Section, with acceptance from the IRS.

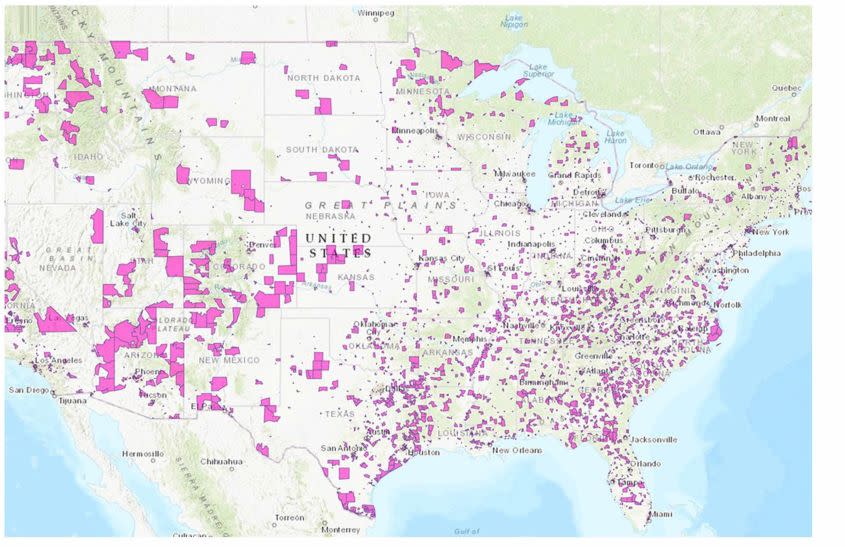

In excess of 8,000 qualified prospect zones exist in the United States, accounting for 12% of all Census tracts. The Department of Housing and Urban Development’s site presents an interactive map highlighting where the option zones are positioned. Rural places make up approximately 23% of them.

Section of Housing and City Improvement

The federal governing administration produced competent prospect zones to persuade investment and economic progress. This landmark laws came with numerous tax rewards for people today who invested via a capable prospect fund. Skilled possibility funds (QOFs) are expense entities, like firms or partnerships, developed to make investments in property in just possibility zones.

Investments produced by suitable opportunity money must fulfill certain conditions. For example, authentic estate assets must be new or significantly renovated. It is prohibited to order existing true estate devoid of earning sizeable enhancements. A substantial advancement to an chance zone residence usually means that the chance fund investments must be equivalent to or larger than the worth of the asset and will have to be concluded inside of 30 months.

Positive aspects of a Qualified Option Zone

Funds gains deferrals from prior investments are the main tax advantage of option zone applications. In individual, an investor who transfers cash gains from a prior financial commitment into a QOF in 180 days of the sale date can defer taxation on the achieve right until December 31, 2026.

Chance zones can be a fantastic answer for any funds gains, lengthy or short expression. The gains could be from the sale of serious estate, sale of a closely held organization, or from the sale of any type of appreciated asset, such as shares, artwork, collections or other assets of benefit.

In addition, if experienced opportunity fund traders maintain their investments for at least 5 a long time, they can further cut down their deferred money achieve because their charge foundation will enhance by 10% at that issue (Note: below latest tax law, an investment decision designed following December 31, 2021, will be ineligible for the 10% basis move-up considering that deferred taxation on December 31, 2026, will come about prior to the five-year holding interval staying satisfied). And all those who can hold their QOF investments for 10 yrs or a lot more can take pleasure in 100% tax-totally free gains. This presents investors a aggressive advantage in prosperity generation.

What Are 1031 Exchanges?

By taking part in a 1031 exchange, traders can exchange a single investment home for yet another although at the exact time deferring the money gains taxes that would normally be because of at the time of sale. In this strategy, buyers can substantially make improvements to their homes without having shelling out taxes on the profits.

If you want to dive far more into 1031 Exchanges, verify out my masterclass, Grasp The 1031 Exchange.

Benefits of a 1031 Exchange

Similar to capable chance zones, the key reward of a 1031 trade is tax deferral. As soon as a property operator exchanges an financial commitment residence for a different house of a “like kind,” they get to defer the taxes on their gains until finally the substitution residence is bought. This tax deferral offers buyers extra cash accessible to maximize their purchasing energy by way of higher down payments and higher-priced alternative home purchases. In this way, traders can leverage their dollars and mature their prosperity.

In addition, 1031 exchanges are also pretty flexible as considerably as the house type is involved. Traders can, for case in point, trade one residence for yet another, consolidate a number of properties into a solitary a person, or exchange the present residence for various more compact types.

Which Expenditure Do I Opt for: QOZ or 1031 Trade?

While both QOZs and 1031 exchanges provide to defer capital gains taxes, there are substantial discrepancies concerning them. Appropriately, determining which system is preferable relies upon on the investor’s goals and goals.

For Tax Deferral, 1031 Exchanges Have the Edge

If the investor’s key purpose is to stay in the real estate investing enterprise for the rest of their lifetime, the 1031 exchange is outstanding to QOZs. These investors do not want to cash out, or perhaps they only want to dollars out at a a great deal later date (and they are well prepared to fork out funds gains taxes at that time if they do).

For Noticing Earnings, QOZ Money Have the Edge

If an trader intends to realize earnings at some stage for the duration of their lifetime, a QOZ may possibly be a far better selection for the reason that QOZs different the basis and the money acquire. On the other hand, if an trader needs to retain their basis for other investments or chances, they may well pick out to devote only the money gains. An trader who takes advantage of a 1031 exchange has a unique downside due to the fact, in get to have a entire deferral of taxes, they will need to roll all the proceeds from the sale into the new investment.

As Estate Preparing Resource, 1031 Exchanges Have the Edge

Simply because an investor can have the tax deferral from a 1031 trade ahead indefinitely, 1031 exchanges can be beneficial estate organizing instruments. Deferred gains are removed on passing. Suppose the trader retains on to the house for the rest of their lives. In that circumstance, their heirs receive a action-up foundation dependent on the property’s truthful current market price at the time of passing, wiping out any before appreciation in value. In addition, capital get taxes are not imposed on these heirs when the asset is marketed.

On the other hand, any beneficiaries of a QOZ fund who inherit their curiosity prior to Dec. 31, 2026, will inherit the initial tax basis in the investment decision since QOZs do not present a stage-up on loss of life. Thus, they will be liable for the taxes even so, if the successor proceeds to keep the QOZ fund fascination for at the very least 10 decades immediately after the original expense, their tax foundation will be stepped-up to the reasonable industry benefit of the expense on disposition less than the QOZ plan.

Vital Takeaways

-

A skilled opportunity zone and a 1031 exchange give serious estate traders tax positive aspects.

-

A QOZ and a 1031 tax exchange demand distinctive approaches that investors need to have to fully grasp in advance of picking which route to get.

-

Traders in competent chance zones profit principally from the deferral of money gains from prior investments.

-

The crucial benefit of a 1031 trade is that investors can swap or consolidate expense qualities whilst deferring money gains taxes at the very same time.

-

When it will come to deferring taxes, 1031 trade has the advantage.

-

When it comes to income realization, the edge goes to experienced prospect zones.

-

If you assess QOZ and 1031 trade in estate planning, the 1031 trade has the gain.

Investing in 1031 exchanges offers numerous gains to traders, such as substantial tax strengths and the possibility to develop and leverage their prosperity with minimal economic obligations. However, to completely benefit from them, you ought to adhere to certain timeframes and procedures.

It is really vital for an trader to often take into account their extended- and shorter-term plans as nicely as their profits and fairness targets. 1031 exchanges and qualified opportunity zones both equally have their respective pros and cons. A knowledgeable planner and tax staff can support an trader determine which strategy or combination of tactics can ideal provide an investor’s needs.

You may well also like

The Fantasy of Passive Authentic Estate Investing

Your Information to Roth Conversions

30 Finest Kirkland Goods You Should really Invest in at Costco

[ad_2]

Supply connection

More Stories

Digital Trends and Technologies Transforming CX in Banking and Finance

Mortgages – The Best Time to Finance

Business Opportunities – Which Business Idea Is Right For You?