[ad_1]

Ford Motor Corporation (NYSE:F) acquired a whole lot of awareness from a considerable selling price motion on the NYSE in excess of the previous number of months, rising to US$17.75 at 1 point, and dropping to the lows of US$12.42. Some share price actions can give buyers a improved prospect to enter into the inventory, and potentially invest in at a decreased cost. A issue to response is whether or not Ford Motor’s current investing selling price of US$12.75 reflective of the real worth of the big-cap? Or is it at present undervalued, delivering us with the opportunity to buy? Let us acquire a appear at Ford Motor’s outlook and price primarily based on the most current money details to see if there are any catalysts for a rate modify.

Look at out our newest investigation for Ford Motor

What is actually the possibility in Ford Motor?

Wonderful information for investors – Ford Motor is continue to investing at a pretty low-cost selling price in accordance to my rate a number of product, in which I evaluate the firm’s price tag-to-earnings ratio to the sector normal. I have utilised the price-to-earnings ratio in this instance for the reason that there’s not plenty of visibility to forecast its income flows. The stock’s ratio of 4.43x is now properly-down below the business average of 14.33x, that means that it is buying and selling at a much less expensive rate relative to its friends. What’s a lot more appealing is that, Ford Motor’s share cost is rather unstable, which presents us a lot more possibilities to purchase considering the fact that the share selling price could sink decreased (or increase higher) in the foreseeable future. This is based mostly on its superior beta, which is a very good indicator for how a lot the stock moves relative to the rest of the market place.

Can we expect development from Ford Motor?

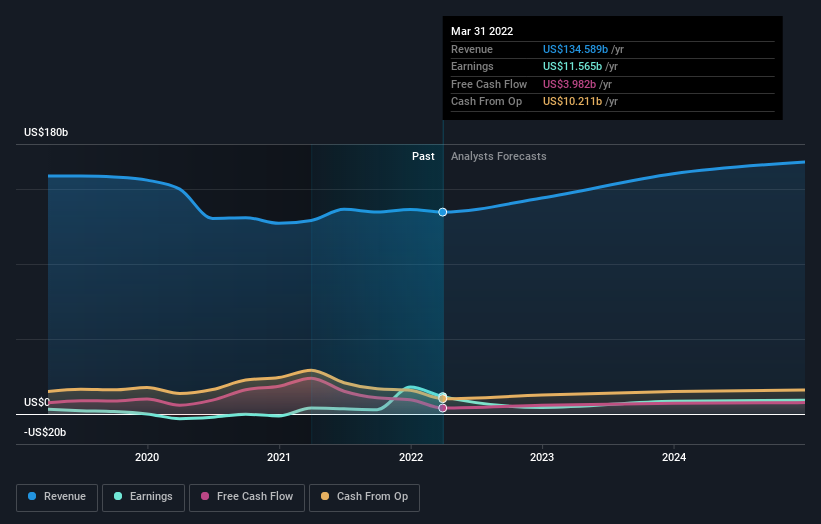

Foreseeable future outlook is an essential aspect when you’re searching at acquiring a inventory, primarily if you are an trader hunting for growth in your portfolio. Although price buyers would argue that it’s the intrinsic value relative to the selling price that matter the most, a extra powerful expense thesis would be substantial growth possible at a affordable price tag. However, with a damaging financial gain advancement of -19% predicted about the subsequent few of decades, near-time period progress definitely does not show up to be a driver for a acquire decision for Ford Motor. This certainty suggestions the risk-return scale towards larger risk.

What this means for you:

Are you a shareholder? Although F is at the moment buying and selling beneath the sector PE ratio, the adverse prospect of damaging development delivers about some diploma of chance. Think about whether or not you want to improve your portfolio exposure to F, or whether or not diversifying into a different stock may well be a much better go for your full hazard and return.

Are you a possible investor? If you’ve been preserving tabs on F for some time, but hesitant on creating the leap, I advise you exploration further more into the inventory. Given its present price tag numerous, now is a good time to make a decision. But preserve in mind the dangers that appear with detrimental expansion prospects in the future.

In mild of this, if you would like to do a lot more investigation on the company, it is really very important to be informed of the challenges included. Our evaluation demonstrates 3 warning indications for Ford Motor (1 would not sit too very well with us!) and we strongly advise you appear at these before investing.

If you are no extended interested in Ford Motor, you can use our absolutely free platform to see our checklist of above 50 other stocks with a significant expansion opportunity.

Have suggestions on this write-up? Anxious about the content material? Get in contact with us specifically. Alternatively, e mail editorial-team (at) simplywallst.com.

This post by Just Wall St is general in character. We offer commentary based mostly on historical data and analyst forecasts only applying an unbiased methodology and our posts are not intended to be financial suggestions. It does not constitute a advice to get or provide any stock, and does not take account of your targets, or your fiscal situation. We aim to provide you very long-expression focused assessment pushed by elementary information. Be aware that our evaluation might not factor in the most current selling price-sensitive organization bulletins or qualitative product. Simply just Wall St has no situation in any shares mentioned.

[ad_2]

Resource website link

More Stories

Digital Trends and Technologies Transforming CX in Banking and Finance

Mortgages – The Best Time to Finance

Business Opportunities – Which Business Idea Is Right For You?