[ad_1]

gesrey/iStock via Getty Images

Major Thesis & Background

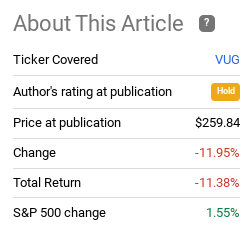

The purpose of this article is to consider the Vanguard Progress ETF (NYSEARCA:VUG) as an financial investment possibility at its present-day marketplace value. This is a fund I cover when I am looking at obtaining in to the “progress” topic, though I have been lukewarm on that plan for a whilst. In fact, when I past covered VUG final calendar year, I placed a neutral/maintain score on the fund. Wanting back, this was the right outlook. When the industry is up slightly, VUG is in correction territory, displaying a disproportionate reduction:

Fund Efficiency Given that Past Overview (In search of Alpha)

When this efficiency about the past year and a fifty percent is not also disturbing, if we take a extra small-time period glance at the fund the stress truly becomes obvious. Given that 2022 started, VUG has noticed a fall near 30%:

YTD Overall performance (Looking for Alpha)

Every time I see such massive swings in small timeframes, I get interested. This obtained to pondering if purchasing in to VUG helps make perception right now, irrespective of all the destructive headlines we are looking at about the market place of late. Just after a assessment of this fund, I do see sufficient justification for heading prolonged here. Whilst headwinds definitely exist, I feel the current market provide-off has been a little bit much too fierce, and we could see an upward correction. If so, VUG will advantage, for the causes I will define under.

Worldwide Progress Downgraded, But Probably Which is Ok

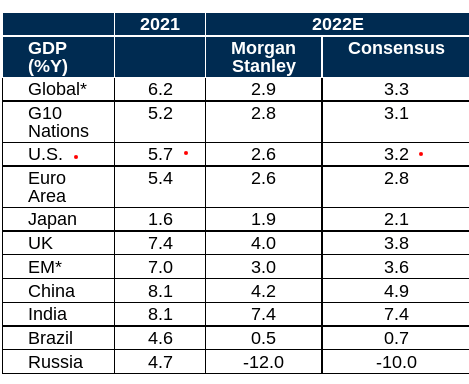

To get started, let us consider inventory of the global economic system. As 2022 has gotten underway, the industry has been strike by war in Europe, swift inflation, and central financial institutions boosting curiosity costs. The effect to fairness and bond marketplaces has been extreme, but it has extended to broader financial metrics as nicely. GDP progress figures have been revised downward due to the fact the year started, and there are signals they may possibly be revised down again. As it stands now, the U.S. is expected to mature about 3% this 12 months:

GDP Progress Estimates (Morgan Stanley)

Fortuitously, that is not far too poor of a range. Nonetheless, with war in Europe dragging on, inflation continuing to continue to be perfectly above estimates, and central banks remaining pressured to act further, the characteristics accountable for the downgrades to GDP progress thus much continue being in put. Thus, expansion in the U.S. (and across the earth) could wind up being even weaker in 2022 than we hope halfway via the calendar year.

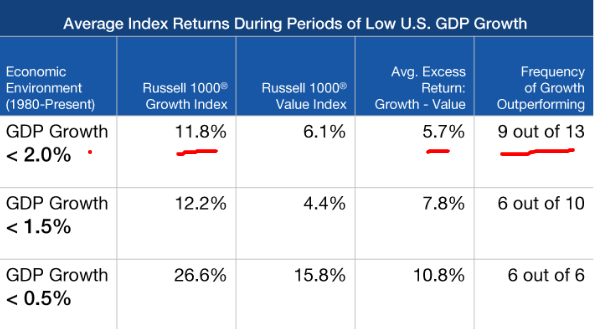

With this in intellect, it would make sense to keep away from threat-on financial investment performs, suitable? This would the natural way involve growth-oriented ETFs, these types of as VUG. When intuitive, the reality is that expansion money frequently conduct effectively all through intervals of small GDP advancement. This tells me that if we do see a downgrade and subsequent reduce growth, then this could wind up being a interval of gains for VUG. To recognize why, enable us glimpse at historical past. Wanting back again four many years, when GDP expansion is in the .5%-2% array, the value index beneath-performs the expansion index:

GDP Estimates (Lord Abbett)

I highlighted the top area mainly because growth in the 2% array is in all probability the most realistic estimate if we see a downgrade once again. If that occurs, there is a solid chance that value is not the superior play – progress is. In the bulk of circumstances there is a substantial divergence involving the two. As a result, if the GDP selection gets revised down but holds in the 2% array, there is a fantastic probability VUG sees gains. This supports a obtain watch now.

There Are Vibrant Places To Be Discovered

As my viewers know, I am not accurately an optimistic these days. I am advocating being diversified, which consists of on the lookout overseas for benefit. So it might appear to be as odd to advise a U.S.-dominated, big-cap fund like VUG. In fairness, a several weeks back I may possibly not have, but the fall down to calendar-yr lows has me asking yourself just how terrible factors truly are. Stocks are receiving hammered, and VUG is down so significantly it looks like the earth is slipping aside. Indeed, there is a ton of terrible information out there, but there are vivid places much too. I sense this is not balancing out the poor sufficient – traders are much too targeted on the unfavorable headlines and not provided enough credence to the constructive news.

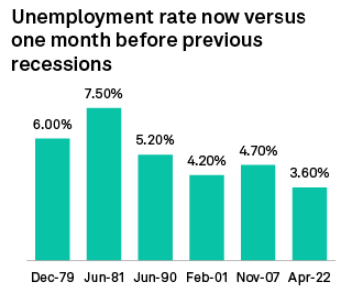

So, what are some of the positives? 1 is the labor market place, which continues to be rather restricted. Job openings are up, and unemployment is down. This is supplying employees pricing electrical power in a way we have not witnessed in a extended time. This reality is assisting functioning households, specifically center and upper-middle class homes, cope with the mounting cost of living. I convey this up due to the fact it is a extremely vital issue. In earlier recessions, the unemployment has by no means been this low. In point, it is typically markedly better:

Unemployment Charges Prior To The Start off of Recessions (S&P World wide)

I carry this up since I do not see the U.S. financial system collapsing. American homes are understandably nervous. But the task current market is very hot, which indicates homes are equipped to take care of the growing selling prices we have seen. There is a limit to this yes, but so considerably, the country is handling it. Even more, other key troubles, like the conflict in Ukraine, is a faraway difficulty. This is not a rationale to steer clear of the U.S. inventory market. In simple fact, it may be a purpose to think about it, at the price of produced and emerging economies in Europe, which are nearer to the front-line. Eventually, I want readers to fully grasp there is fantastic information to be found, we just have to look outside of the headlines to locate it.

Progress Will not Normally Signify No Income

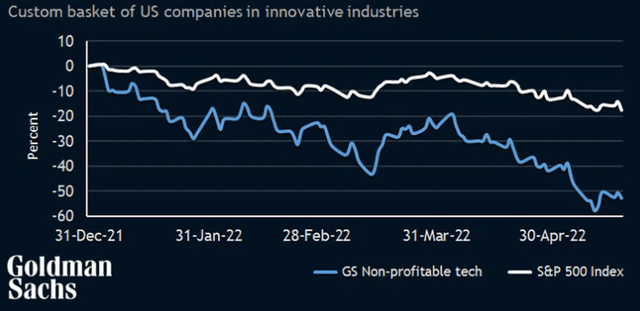

I now want to choose much more about VUG particularly. Plainly, this is a “progress” thought. But “development” can mean quite a few matters. Frequently it signifies corporations that are new, expanding promptly, or have a ton of opportunity. These are usually dangerous endeavors and are firms that are short of income. During moments of inflation and mounting interest premiums, traders can drop patience waiting on these “growth” companies to clearly show true returns. This patience is without a doubt what traders are lacking right now. In reality, non-profitable tech businesses (which normally coincide with development suggestions) have been hammered calendar year-to-day. Even though the S&P 500, which is also Tech-heavy, has been punished, non-successful corporations are faring much worse:

YTD Overall performance (Goldman Sachs)

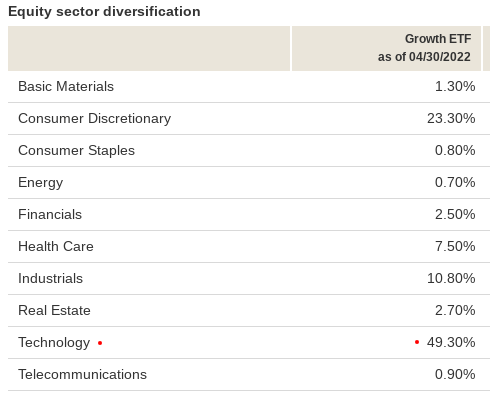

This is suitable to the discussion mainly because VUG is a Tech-oriented growth fund. In truth, the Tech sector can make up almost 50 percent of full fund belongings:

VUG Sector Weightings (Vanguard)

On the area, this could seem to be like the kind of fund to stay away from, based on the prior comments I just designed.

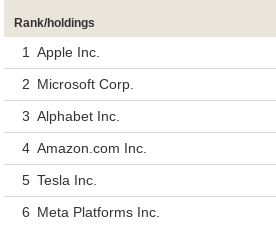

However, we have to take into account that all development is not equivalent. Non-rewarding, modest-cap, trend organizations can frequently be expansion names, that is legitimate. But those are not what I would recommend now, nor is that what VUG owns. While this is a “expansion” fund, it is comprised large-cap advancement shares. The top rated holdings are some of the most recognizable as a consequence:

Major Holdings of VUG (Vanguard)

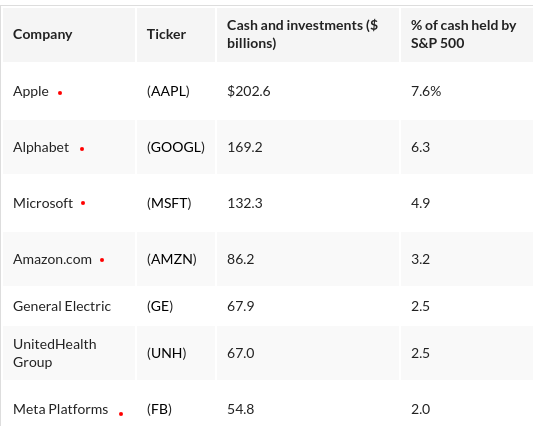

Why is this a very good detail? For a person, these are not all those cash-poor, dangerous firms that have me involved. With the exception of Tesla (TSLA), the other 5 of the best holdings have massive amounts of funds on hand. In fact, they have extra funds than pretty much every other firm in the S&P 500:

Money Offered (FactSet)

The conclusion I attract right here is that these are not the overly dangerous, vulnerable to disappointment development companies that make up other resources. VUG holds some time-examined huge-caps that also materialize to have a lot of cash to temperature even further market and economic volatility. This tends to make me comfortable shopping for-in at these degrees.

The Benefit Gain Has Been Obvious, But Could Be Time To Reverse

My remaining place appears at the progress versus value dialogue that often arrives up when taking into consideration 1 or the other. In all honesty, I see practically nothing improper with owning each, it definitely won’t have to be a a single or the other proposition. But it is also accurate we do not devote in isolation so when we increase to one notion, we are neglecting a different.

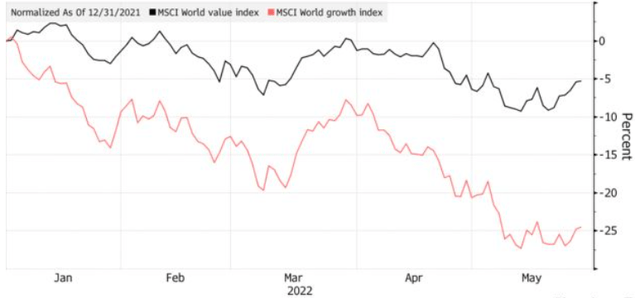

When thinking of year-to-date effectiveness, I would be remiss if I did not acknowledge that price has been the proper move so considerably. With economic anxieties mounting, buyers took convenience in relative price. Although the value index is down this year anyway, the loss is drastically less than the progress index. This is correct for the earth, not just in the U.S.:

Price vs Development Return (Bloomberg)

My takeaway at this juncture is to take a contrarian stance. Accurate, value has been worthwhile, and it can very easily be argued to stick with it. But as a prolonged-term trader who has been in the current market more than fifteen a long time now, I know these tendencies never very last. The equilibrium among development and benefit fluctuates, and this sharp divergence in performance suggests to me a modifying of the guard may possibly be around. Progress is in bear marketplace territory, and that is the time to start off obtaining, in my view.

Bottom line

VUG has had a disaster of a year so much. But brighter times could be ahead. The fund can be seen as risky supplied its 30% yr-to-day reduction and the chance aversion the marketplace looks to have for “advancement” proper now. But I would concentration on the positives. The entire world usually faces challenges, and we usually prevail over them. Even more, VUG is not holding unproven development names. It is chubby some of the greatest names in U.S. tech, many of which have significant cash hoards. This tells me there is some relative basic safety right here, even if macro-headwinds dissipate in the in close proximity to expression. As a final result, I am seeking at beginning a place in VUG, and I would encourage visitors to give this thought some considered at this time.

[ad_2]

Supply website link

More Stories

Digital Trends and Technologies Transforming CX in Banking and Finance

Mortgages – The Best Time to Finance

Business Opportunities – Which Business Idea Is Right For You?