[ad_1]

claffra/iStock by means of Getty Illustrations or photos

The Bearish Thesis

The S&P 500 (SP500) 2022 market-off prolonged to just about 17% drawdown YTD. A different 3% down, and SP500 will be formally in a bear industry.

I was publicly bearish on (SPY) due to the fact March 25th, and the bearish thesis is very straightforward: it’s a historical reality that each and every economic downturn considering the fact that 1947 has been preceded with the Fed’s monetary plan tightening cycle. Hence, provided the present cycle of predicted intense monetary coverage tightening, it can be quite probable that a recessionary bear market will stick to.

Nonetheless, as I defined recently, it appears like a whole-blown bear market has 3 phases: 1) the liquidity-centered promote-off in anticipations of financial policy tightening, 2) an imminent recession offer-off, and 3) the credit score crunch market-off. We are currently in a stage 1 – the liquidity-dependent sell-off.

It is really crucial to take note that the liquidity market-off does not always have to guide to a recession. In point, the 1987 stock market crash of 33% was a liquidity-based mostly provide-off brought on by the expectations of an intense financial coverage tightening. Yet, it did not outcome in a recession or a credit crunch.

Primarily based on the macro indicators from the bond industry, the chance of a recession more than the upcoming 12 months a pretty minimal, and it has been decreasing, as the generate curve widened across all maturities. Most notably, the 10Y-2Y spread widened to .43%.

Centered on Federal Resources futures, the Fed is expected to minimize fascination fees for the first time in December of 2024 – for now this is a signal of probable normalization, but it could also signal the beginning of the recessionary financial plan easing. Thus, dependent on the bond industry indicators, the up coming recession could potentially begin in late 2024.

Consequently, as of now, the chance of an imminent economic downturn likelihood is very low. For that reason, the present 17% drawdown, particularly since April 21st, is associated to the liquidity shock.

The Liquidity Shock

See, each time you get, somebody sells, or each time you promote, any individual purchases. That is termed a liquid industry. What would take place if you preferred to promote, and there have been no customers? That would be an illiquid current market, and you in all probability would not provide. But what if you are forced to sell in an illiquid market place? Obviously, you would have to sell a substantially lower price tag.

Monetary markets are facilitated by market makers – who acquire when you want to promote and sell when you want to get. These are significant frequency traders who make their revenue centered on the bid-talk to spread.

Even so, when the marketplace uncertainty will increase, the industry makers to start with improve their bid-inquire distribute, hence creating the markets much less liquid, and next lessen the current market depth – or the dollar amount they are ready to trade. Ultimately, the industry makers can entirely withdraw from the marketplace.

So, what’s occurring correct now? The Fed’s Economical Security Report of May 22 demonstrates the info that clarifies the current liquidity shock.

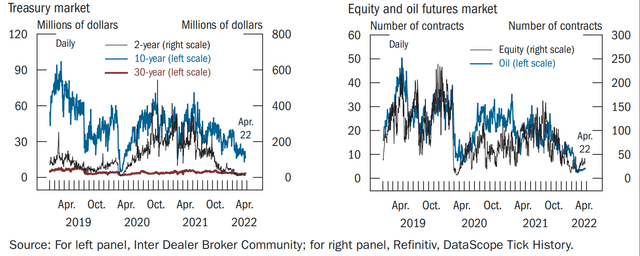

- Owing to the uncertainty relevant to the expected Fed’s financial coverage tightening, the market makers in limited-term bonds drastically decreased the market depth (the black line in left-side graph). Meaning, the institutional buyers who wanted to provide a massive volume to 2Y Treasury Notes could not do it – the marketplace was illiquid. As a outcome, the desire level on 2Y Observe rose sharply – to imply an even extra intense financial coverage tightening.

- Therefore, greater desire premiums on 2Y Take note amplified the perceived chance of a recession, which increased the uncertainty in S&P500 futures (SPX) and decreased the sector depth earning the marketplace illiquid (the black line on ideal-facet graph). That means, substantial institutional traders who wanted to provide a substantial amount of SPX could not do it effectively in an illiquid industry.

The Fed Money Steadiness Report

Be aware, the lessen in marketplace depth – and the resulting liquidity shock, can be traced to the Fed Chair’s Powell speech at the IMF on April 21st – the place he produced really hawkish remarks.

Acquiring Option

The liquidity shock can build a vicious detrimental suggestions loop – exactly where falling asset prices induce margin calls and thus, extra promoting in an previously illiquid sector. As a final result, investors are compelled to market all of their holdings to increase cash to satisfy margin phone calls. As a result, throughout the liquidity shock all assets slide in price, while the US Dollar rises (UUP).

For that reason, the liquidity shocks existing an outstanding obtaining option as quite a few good belongings get discounted. For example, the 1987 crash was an superb SP500 shopping for chance (for any person in hard cash at the base).

The only problem is the forecast when the liquidity shock ends. There are two triggers that conclusion the liquidity shock: 1) the Federal Reserve intervention, like in March of 2020, and 2) the reduction in the underlying uncertainty that built the marketplaces illiquid in the initially spot.

Now, the traders cannot rely on the Fed to intervene with the dovish turn. Even so, the clarity with the regard to predicted monetary coverage is maybe rising – which could trigger the return of market depth in US Treasuries (SHY) (TLT), and even more in the S&P500 futures.

The envisioned financial policy is pushed by the expected inflation. Take note, the extensive-phrase inflation expectations, as measured as the change in between the nominal 10Y Yields and the genuine yields, peaked on April 21st at 3%, and subsequently fell again to the key amount of 2.75%. Consequently, we could say that we have the peak inflation anticipations, which also implies the peak Fed hawkishness – and the rationale to acquire SP500. This is steady with the Kolanovic simply call to incorporate threat belongings on the peak hawkishness.

As a result, I assume that the market place depth will return due to the clarity on the Fed’s plan, at which level, the S&P500 will rally – maybe right into the section 2 or an imminent economic downturn – which could be far off and so it could be a very long rally.

Note, the peak inflation anticipations have to be supported with the peak CPI inflation. Consequently, the Wednesday’s CPI report could be the bring about for the aid rally – if is below the preceding peak. On the other hand, a negative CPI report could intensify the liquidity shock.

As a result, my advice for (SP500) is to hold. We know that that the liquidity shock can be a great deal further, centered on the 1987 crash circumstance, so getting in progress of the clarity of the liquidity shock resolution is like catching the falling knife. So, for starters, let’s see the market place reactions if the peak inflation is verified with the CPI report.

[ad_2]

Resource connection

More Stories

Digital Trends and Technologies Transforming CX in Banking and Finance

Mortgages – The Best Time to Finance

Business Opportunities – Which Business Idea Is Right For You?