[ad_1]

Douglas Rissing/iStock via Getty Illustrations or photos

The Lipper Typical U.S. Treasury Resources classification is composed of funds that make investments mainly in U.S. Treasury expenditures, notes, and bonds. The cash inside this classification experienced an typical length of 12.2 decades as of December 2021.

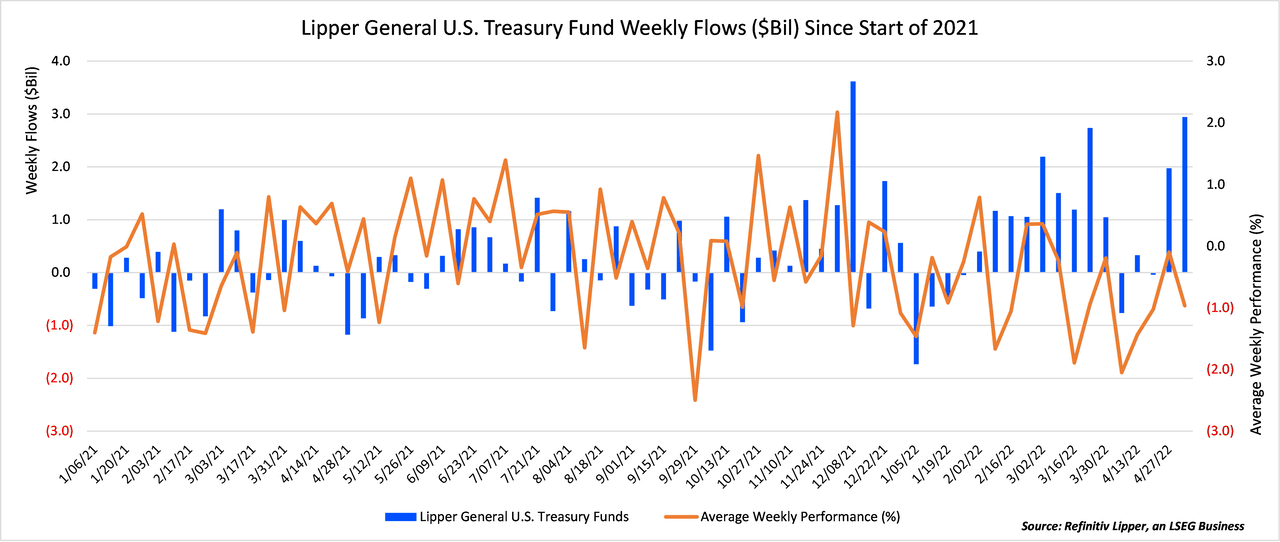

In comparison to other major set money indices like the Bloomberg Municipal Bond Whole Return Index (-8.8%) and the Bloomberg U.S. Mixture Bond Total Return Index (-9.5%), Lipper Common U.S. Treasury Funds have posted a extremely underwhelming calendar year-to-day overall performance as a result of April month conclude of damaging 13.3%.

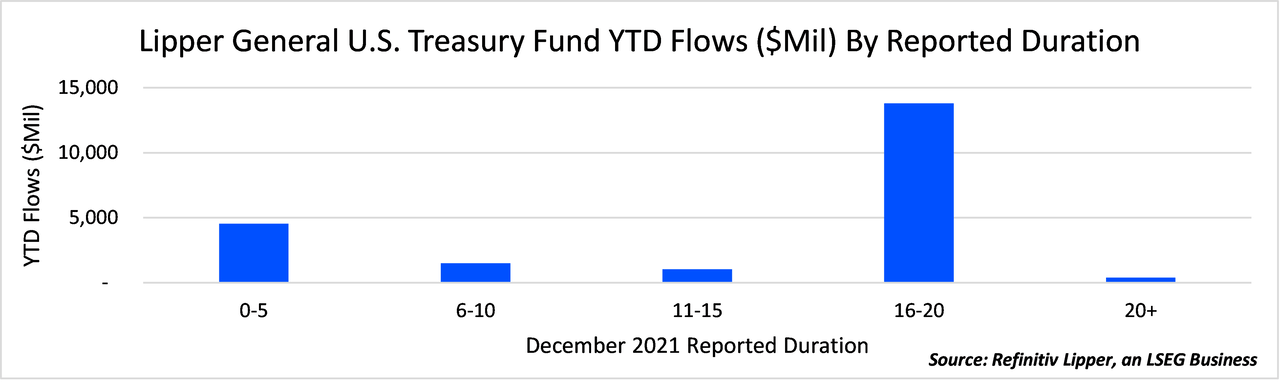

In spite of the bad comparative performance, the classification led the way this earlier fund flows week, attracting $3. billion. Lipper Standard U.S. Treasury Money have also been red scorching due to the fact the get started of the year, pulling in $21.4 billion, making them the 3rd most well-known Lipper classification in that span – powering only Lipper International Cash flow Funds (+$33.4 billion) and Lipper Bank loan Participation Money (+$25.2 billion). Lipper Normal U.S. Treasury Cash also established a quarterly intake file through the fourth quarter of 2021 as they noted inflows of $13.9 billion.

Lipper General US Treasury Cash (Writer) Lipper General US Treasury Fund Flows (Creator)

Wednesday, May perhaps 4, the Federal Reserve policymakers made the decision they will elevate rates by 50 basis points (bps) for the 1st time in a lot more than 20 years. When the substantial hike was mostly anticipated, Federal Reserve Chair Jerome Powell famous that bigger moves ended up not in the Fed’s potential plans. It is continue to forecasted, having said that, that the Fed will elevate charges all through every single of its remaining meetings this year.

With the poor effectiveness of lengthier-dated Treasury bonds currently recognized by way of April, inflationary fears growing, and the present rising charges natural environment in position, the question stands: Why have more time-dated U.S. Treasury Resources captivated so significantly money this 7 days and this calendar year?

To get the response we could will need to consider a action again. Fairness markets year-to-day by April have logged even worse returns than Lipper U.S. Typical Treasury Cash – Nasdaq (-21.2%), Russell 2000 (-17.%), and S&P 500 (-13.3%).

The only U.S. broad-based mostly fairness index to outperform the classification was the DJIA (-9.25%). As desire prices increase, the significant-traveling, already pricey progress and technological innovation shares are in for a rough ride. Principal security, tax exemptions, and assured rates of return grow to be even far more significant as the overall economy appears to be heading toward turbulent moments.

Threat mitigation and diversification are two phrases that have seemed to have turn into fewer captivating throughout the earlier bull market. Goldman Sachs’ economic workforce just final month forecasted there is now a 35% prospect of a U.S. economic downturn more than the upcoming two several years.

Deutsche Financial institution, which originally released its economic downturn base situation as late 2023, has said a downturn by the conclusion of the year is very likely if the Fed continues its aggressive financial tightening. In order to keep away from substantial drawdowns in a broader portfolio, an allocation to Treasuries functions as an solution to diversify danger.

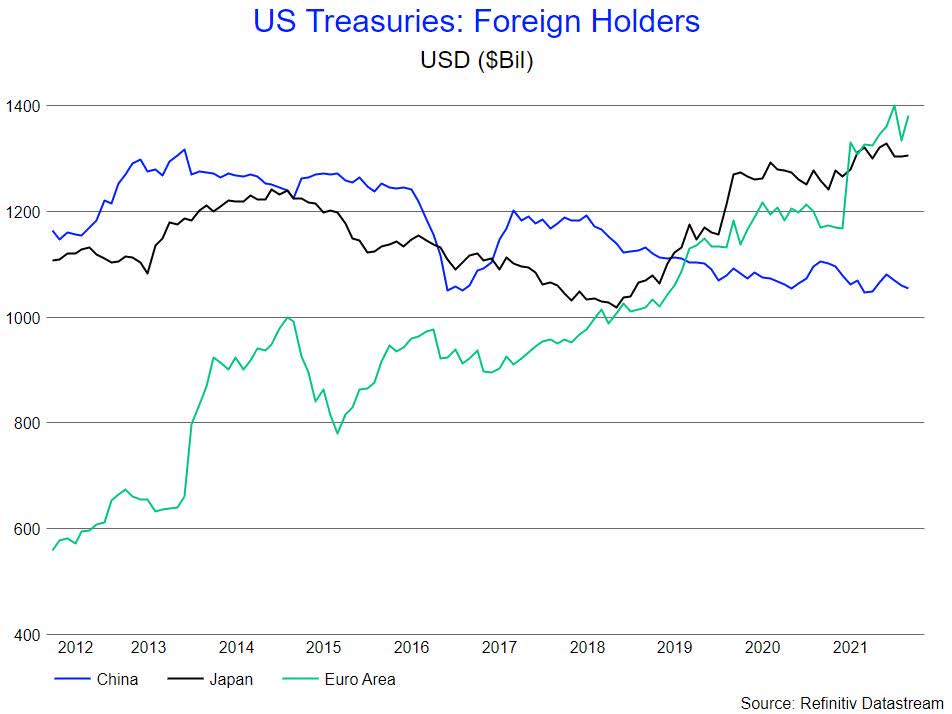

A third practical professional of this Lipper classification in the presented surroundings is the fact that marketplace individuals may possibly think today’s charges now issue in the foreseeable future expectations of soaring premiums. If that is the case, and yields increase considerably less than predicted, the case for holding for a longer time-phrase bonds is a robust a single – a stance lots of overseas investors are betting on.

US Treasuries (Writer)

Editor’s Be aware: The summary bullets for this short article ended up picked out by Looking for Alpha editors.

[ad_2]

Source hyperlink

More Stories

The Best Beautiful Places to Visit in Nepal

Quality Printing with Cartridge Packaging

Republican nominee for Maryland attorney general hosted 9/11 conspiracy radio shows