[ad_1]

Setting up a organization indicates picking the suitable small business variety. Minimal Legal responsibility Business, Corporation, and Partnership are company formations. Read through extra about just about every form or see the ENTRE Institute assessments of KHTS.

Professional Tip💡 GetEmail.io, a free email finder plan, might assist you uncover the electronic mail addresses of money establishments, gifted people today, and achievable clients. Get the email addresses of buyers, company executives, Amazon business enterprise associates, builders, world-wide-web designers, and IT experts promptly and simply. GetEmail.io offers 10 no cost credits.

Read on to understand which kind fits your organization. Examples of just about every:

Corporation

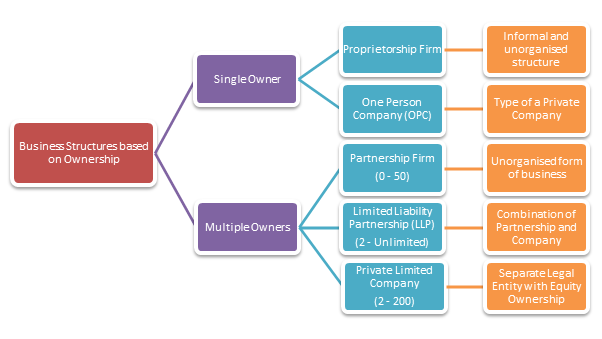

Most organizations are firms that have multiple homeowners, associates, and professionals. In a company, stockholders are not individually accountable for money owed or commitments. The percentage of possession decides threat. Quota dialogue about ENTRE Institute states that if 1 associate loses all their shares, the some others will as well. So, pick your organization sort properly.

IRS has suggested treating unincorporated organizations as partnerships. These modifications may well terminate the shut corporation since they would no cost up statutory small business forms. This technique could possibly herald a new company-type collaboration and hasten the extinction of the common organization. These modifications would raise owners’ business sort adaptability. This short article discusses the deserves and downsides of each individual business structure and how they might earnings from these developments.

LLCs provide confined liability and partnership tax benefits to their entrepreneurs. These advantages aren’t more than enough to pick involving them. As ENTRE’s Inc. web site demonstrates, important documentation have to be presented to the condition business regulating group to prevent personal bankruptcy. LLCs are equivalent to C-Corps but never have a double tax filter.

When a corporation just cannot problem shares or participate in commercial routines, it might make firm-wide conclusions. This is essential if you want to offer you shares or financial loans. Even with this, a agency may possibly not be capable to near if a stakeholder leaves. A company may perhaps exist eternally, and stockholders can promote at any moment.

Partnership

There are a variety of partnering solutions. Some are much more advanced than others the two may be put together. Sole proprietorships permit each associate to take full personal accountability for all business decisions. A sole proprietorship is a simple firm framework, but it may well not match you. For more, call your community authorities. Partnerships are an fantastic organization arrangement for numerous.

In a partnership, a typical partnership arrangement defines earnings and losses. Most state legislation call for common partners to share earnings and losses similarly, while the arrangement could possibly enable for a additional significant income share. Some LLPs need all companions to post a single type. A common partnership settlement could support individuals who find a restricted form, ENTRE Institute assessments reveal. Irrespective of kind, a general partnership agreement will help protect against lawful problems.

Examine this way too: What organization need to I start out?

A partnership arrangement is demanded because each partner’s obligations and dangers are substantial. So, companions are far more accountable for their company’s financial achievement. As partnerships are not unbiased lawful corporations, they do not shelter contributors from personal debts. Thanks to joint and many obligations, each individual husband or wife is dependable for the others’ obligations. Contribution rights apply to them.

Partnerships could be helpful. A business partner could enhance one’s community, give marketplace insights, and encourage the agency. In a partnership, personal debt, risk, and losses are shared. Partners are accountable for the company’s obligations so, a partnership need to be monetarily sound to survive. If the agency collapses, a creditor may well choose them.

Ltd.

To register a limited partnership, there are a handful of factors to do. Initial, get a federal tax ID, akin to a social safety number. The 9-digit number identifies your business for tax causes and will help you sign up bank accounts and recruit employees. You may well continue once registered. Condition processing timeframes vary widely.

LLCs have typical and minimal companions. Limited companions really don’t operate the agency but share responsibility. Normal associates run the business, whereas limited partners are just liable for debts. Limited partnerships are utilized by investment and hedge companies. Restricted partnerships are an superb solution for business owners who wish to improve their corporations devoid of sacrificing manage.

Ahead of building a minimal partnership, take into consideration your tax obligations. A pass-as a result of tax arrangement stops double taxes. This method is acceptable for the significantly less affluent. Business taxes depend on the partners’ earnings tax levels, whereas a C enterprise gains people today with a major annually cash flow. Consult a tax attorney or accountant if you have challenges pertaining to business form.

There are quite a few explanations why constrained partnerships are beautiful. Exterior investors like the constrained companion position since it shields them from personal accountability. Constrained partnerships have the very same go-by means of taxes as typical partnerships. According to ENTRE Institute assessments, profits and losses are transmitted by way of the corporate entity to the homeowners, and associates are taxed at their tax concentrations. Quite a few companies opt for a constrained partnership for these good reasons.

[ad_2]

Supply hyperlink

More Stories

The Best Beautiful Places to Visit in Nepal

Quality Printing with Cartridge Packaging

Republican nominee for Maryland attorney general hosted 9/11 conspiracy radio shows