[ad_1]

Justin Sullivan/Getty Photographs News

On April 26th, ahead of the sector opens, the administration staff at industrial conglomerate Normal Electric powered (NYSE:GE) is owing to report fiscal general performance covering the 1st quarter of the firm’s 2022 fiscal calendar year. As we approach that date, there are a couple of significant aspects that investors should continue to keep a near eye on. These are items that could have a material affect on the firm’s prospective clients relocating ahead, particularly as it moves ahead to spin off specific functions and target on its main companies. Very long term, I feel that Common Electrical will generate appealing returns for its shareholders. But it is really not extremely hard for information introduced in any supplied quarter to modify this image substantially. For the reason that of this, buyers ought to be wise to conduct the acceptable because of diligence by looking at for the most critical factors of the business that will in the end establish its lengthy-phrase trajectory.

Watch GE’s financial debt and cash move

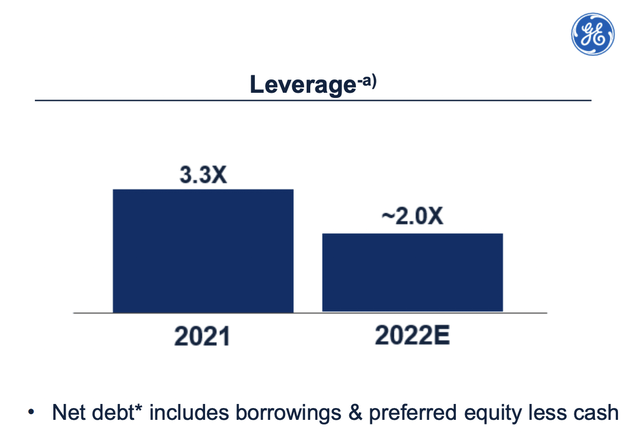

Two of the most important troubles facing Common Electrical in new many years have been the firm’s personal debt and its money movement. Struggling functions, brought about by a mixture of elements like the COVID-19 pandemic, issues with the Boeing (BA) Max aircrafts, and the company’s Electric power section, not to point out other a person-off troubles like insurance coverage and pension reserves, prevented the sort of hard cash stream the corporation essential in order to considerably pay down financial debt. To handle this challenge, the firm did market off or spin off specific business enterprise models, leaving what we in the long run have today. As of the stop of the company’s 2021 fiscal year, it experienced a net leverage ratio of 3.3. However, if you use the credit rating company-aligned definition of internet leverage, the ratio would have been a bit increased at roughly 5.4.

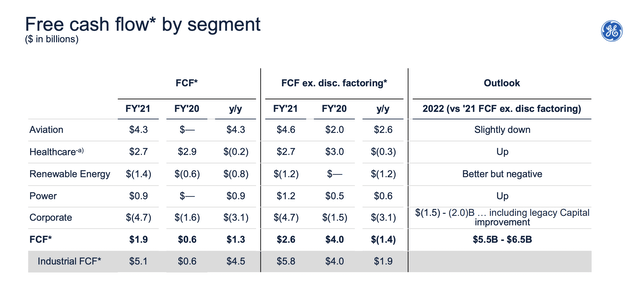

General Electric powered

At this issue in time, management’s objective is to lessen this leverage even more, with a internet leverage ratio target for the finish of the 2022 fiscal calendar year of 2. In order to execute this, the company will have to do effectively to make desirable dollars flows. For the 2022 fiscal year, administration is at present forecasting absolutely free funds circulation from its industrial functions of between $5.5 billion and $6.5 billion. Which is up from the $5.1 billion the business claimed for its 2021 fiscal yr. Not only that, management expects the pattern to continue on, with a present goal for the 2023 fiscal calendar year of free funds move from industrial functions of $7 billion or extra. This should occur as the company’s core functions strengthen and as expense cutting initiatives pay out off.

Standard Electric

Normally, this is just one spot buyers who want to pay back shut notice to. Given the inflationary surroundings, it’s unsure what may possibly arrive to move from a dollars flow viewpoint. And if the organization falls small on that, its target for personal debt reduction could be at stake. But if the company, like so several other organizations I have appeared at, succeeds in actually benefiting from the inflationary natural environment, the end result for shareholders could be excellent. At the conclusion of the working day, a good deal on this front will be determined by the mother nature of the firm’s contracts. A important part of the firm’s functions come from backlog that can be booked yrs in advance. If the terms on this backlog guarantee preset pricing at a time when the company may possibly be liable for shelling out the market price on provides, inflation could occur to chunk it.

Appear to the skies

Today, the core of Basic Electric powered is its Aviation phase. Prior to the COVID-19 pandemic, this unit was each the greatest and fastest-rising part of the enterprise. It is also, by significantly, the most financially rewarding, symbolizing $4.3 billion of the $5.1 billion in industrial stage free of charge money movement the organization claimed for 2021. At current, management has higher expectations for this device. Their current forecast is for its prime line to rise by 20% or far more during 2022. Although this may seem not likely for a substantial and experienced procedure, it is also real that air targeted traffic is finding up immensely.

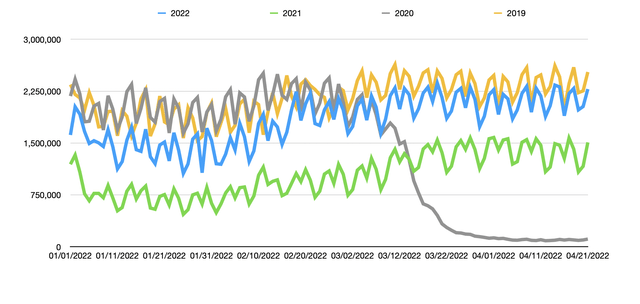

Creator – TSA Knowledge

As you can see in the chart earlier mentioned, air targeted visitors enplanements documented by the TSA have recovered appreciably from the COVID-19 pandemic. As an instance, choose the info for April 21st from every single of the past couple of several years. This calendar year, the TSA noted 2.28 million enplanements. That compares to the 1.51 million reported one yr earlier and is up from the paltry 111,627 claimed the identical time of 2020. Site visitors is continue to down below the 2.53 million reported for the 2019 fiscal year. But the in general development is good and, on the total, sturdy. This ought to travel aircraft units in for assistance and should in the end push need for the engines the company makes. If there is 1 aspect to the corporation that is likely to glow, it is this one.

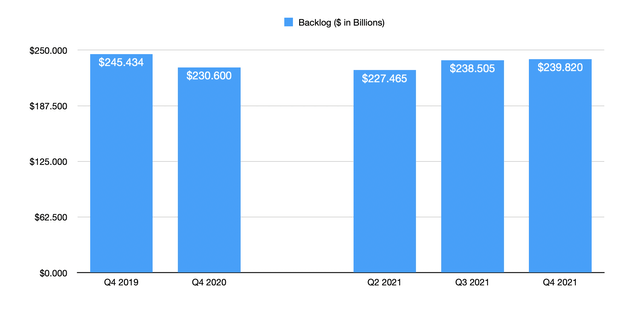

Normal Electrical – Backlog and separation information

In addition to the aforementioned products, traders would also be clever to appear at a couple of other variables. The to start with would be the company’s backlog. Again at the end of the company’s 2019 fiscal yr, it posted backlog of $245.43 billion. This variety plunged in the months soon after, driven by weak spot in the firm’s Energy phase and simply because of broader weak point brought on by economic circumstances. As of the end of past yr, backlog stood at $239.82 billion. That is up 4% 12 months in excess of 12 months as opposed to the $230.60 billion looking at recorded at the conclusion of 2020. How very well the firm performs from a backlog standpoint will be essential due to the fact it is a leading indicator of how small business must be in the ensuing decades.

Creator – GE

The previous thing that investors need to be on the lookout for would be news associated to the company’s spinoff options. The latest objective is to spin off the company’s Health care unit someday in early 2023. At existing, management intends to retain a 19.9% ownership in that device. In addition, the business is going to be spinning off its Renewable Energy, Ability, and GE Digital functions into a individual publicly-traded enterprise someday in early 2024. Any form of information on the position of these ideas could be extremely crucial.

Takeaway

At this moment in time, I view Common Electrical as an desirable turnaround prospect. Undoubtedly, the worst for the company is in the rearview mirror. Even so, that doesn’t suggest it truly is out of the woods totally. Consistently shifting market situations could consequence in beneficial or detrimental developments for the corporation, as could adjustments in management’s conclusions. So lengthy as we never have any horrible detrimental surprises, I sense like the long term for the organization will be captivating. But until eventually the news arrives out, traders should really wait around with bated breath.

[ad_2]

Supply link

More Stories

The Best Beautiful Places to Visit in Nepal

Quality Printing with Cartridge Packaging

Republican nominee for Maryland attorney general hosted 9/11 conspiracy radio shows