[ad_1]

jetcityimage/iStock Editorial by way of Getty Illustrations or photos

Write-up Thesis

General Electric Firm (NYSE:GE) is an embattled inventory that has vastly underperformed the marketplace more than the final 12 months. Some of the firm’s businesses have a fantastic extended-time period outlook, but profitability challenges and weak shareholder returns are headwinds going forward. In general, it appears like other industrial corporations could be improved choices for the coming many years.

The latest Underperformance Induced By Macro Headwinds

Basic Electric powered has dropped from a significant of far more than $110 for each share final fall to just $70 as I create this posting, which would make for a drop of shut to 40%. This vastly underperformed the broad industry. As an industrial enterprise, Common Electric powered obviously is exposed to the energy of the total financial state. And since a recession has turn into extra probable in the new past, the outlook for Normal Electrical has worsened, to some degree. But that’s not all there is. The firm is also negatively impacted by offer chain challenges triggered by the present-day Russia-Ukraine war and by lockdown steps in China. With its different organization units demanding elements and resources from all about the world, disruptions to world trade or to manufacturing in particular areas hurts Typical Electric’s means to make and offer elements.

This was mirrored by the truth that Typical Electric’s natural revenue was up by only 1% during its fiscal very first quarter, which greatly skipped analyst estimates. This is also not at all a solid outcome when we think about that the prior year’s quarter, Q1 2021, was even now seriously impacted by the pandemic. This built for a alternatively effortless comparison for GE, and however the organization noticed its profits rise by just 1% at a time when inflation is working at 8% and extra. On the other hand, it need to also be observed that Common Electric’s business executed better when it will come to making new orders, as these were up 13% calendar year about year on an natural foundation. This was forward of the rate of inflation and bodes perfectly for business enterprise advancement in the foreseeable future, but due to the aforementioned offer chain troubles, GE is not in a position to capitalize on the healthier need for its products proper now.

GE Stock Vital Metrics

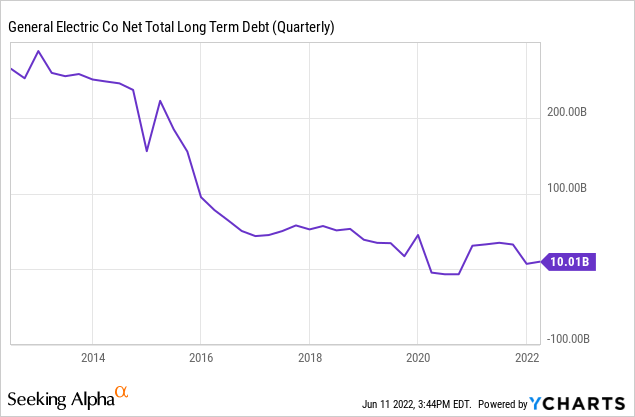

On the lookout into the figures, the 1st pretty important just one is GE’s personal debt load. The firm has massively underperformed the wide marketplace in recent decades, as shares dropped by close to 70% about the last 5 yrs, whilst GE is also down far more than 50% over the previous 10 years. That was, to a big diploma, the outcome of its way-way too-high debt load in the earlier. That has damage investors’ trust when it comes to the lengthy-phrase fiscal well being of the corporation, which compelled management to promote business enterprise unit immediately after business unit in get to totally free up funds that could be applied for credit card debt reduction. Typical Electric’s dividend reduce also was the result of also-superior credit card debt levels in the earlier. Basic Electric powered has built important progress in that regard more than the decades, nevertheless:

In actuality, Basic Electric’s net extended-expression financial debt dropped from as superior as $300 billion a 10 years back to just $10 billion as of the close of the most new quarter. Which is a wonderful deleveraging success, even though it is significant to observe that it did not come for cost-free — the asset income that had been desired to attain this feat have created GE’s revenue drop by 50 percent about the final 10 years, from close to $140 billion to all around $70 billion. Nonetheless, just one can now say that Normal Electric powered is in a fiscally healthier place currently, functioning with personal debt stages that are not at all problematic, even when we account for the truth that curiosity charges have been rising and may possibly carry on to increase in the coming yrs.

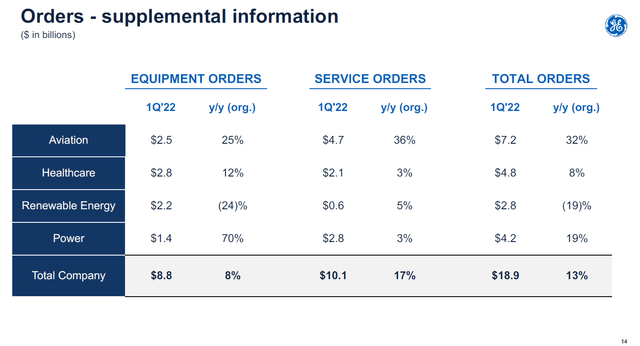

When it arrives to GE’s in the vicinity of-term outlook, the point that orders are trending above income is good. Earnings in the course of Q1 was $16.4 billion, even though GE managed to choose in new orders of $19 billion for the duration of the same period. A e-book-to-invoice ratio of over 1. is usually a good sign for the firm’s earnings overall performance in the coming quarters. As we can see in the subsequent chart, buy functionality was pretty uneven across GE’s different business models:

GE presentation

Orders had been up by a very solid 32% in the Aviation section, which will be the upcoming GE once Healthcare and Renewable Vitality & Ability have been spun off, which will happen in early 2023 and early 2024, respectively. The solid get expansion in the Aviation section can be attributed to the more rapidly-than-anticipated recovery of international air travel. In late 2020 and early 2021, there had been nonetheless quite a few lockdown steps in position all over the entire world, and air travel was incredibly restricted. But as we have seen given that then, limitations received eased in additional and extra nations, and need for air journey recovered substantially. Delta (DAL), for example, has just stated that the corporation sees earnings thoroughly recovering to 2019 concentrations in Q2. That in a natural way is a beneficial for airlines and their demand from customers for new machines, which is, in switch, superior for GE Aviation. The simple fact that large oil/kerosene selling prices make investments in more recent, additional economical engines far more eye-catching is one more tailwind for the section in the recent setting. In the lengthy operate, a lot of gurus see air journey continuing to improve, which is why GE Aviation frequently has a reliable long-time period growth outlook, even although the unit will likely often be cyclical to some degree.

The purchase general performance for the Renewable Energy segment, on the other hand, was not strong at all, as numbers were being down virtually 20% calendar year about year. With Chinese wind turbine makers attaining a lot more and far more market share thanks to value pros, and with the recent vitality disaster generating some governments re-prioritize their vitality investing plans, the market place predicament for the renewable vitality company is just not strong. Fortunately, this was not regarded as a really precious GE device in any case, so headwinds for this section shouldn’t turn into extremely huge challenges for the stock’s over-all efficiency in the coming yrs.

Health care orders were up by 8%, which was in line with inflation. This is a non-cyclical, trusted company with out an overly robust development outlook, so the Health care segment purchase intake was good, while not excellent.

GE up-to-date its assistance that was to begin with presented in January and foresaw earnings per share of $2.80 to $3.50 and absolutely free hard cash movement of $5.5 billion to $6.5 billion. As of the Q1 earnings presentation, administration indicated that benefits ended up at the moment trending in the direction of the decrease conclude of the steerage variety. Thanks to the aforementioned macro headwinds and cost inflation, this just isn’t stunning. Earnings per share of all-around $2.90 or so and cost-free funds stream of a small much less than $6 billion are so what traders can count on this year.

In which Will Normal Electric’s Inventory Be In 2025?

Primarily based on the EPS selection, shares are relatively pricy, with a mid-20s earnings a number of. Relative to cost-free money flows, the valuation appears to be reasonable although, as GE trades at all around 15x this year’s predicted no cost dollars circulation. For extended-term traders, the outlook further than 2022 is more significant, having said that.

GE’s Aviation and Health care corporations are extremely interesting, as they generate reliable margins in the higher-teens selection (compared to damaging margins in the Renewable Vitality phase), and due to the fact GE has favorable current market positions in these marketplaces with a good extensive-term progress outlook. These two units are where by most of the benefit of GE lies. Concerning these two models, GE generates close to $40 billion a yr annually. That amount will not explode upwards but ought to development up at a reliable pace over time. Mid-one-digit annual development could make that amount increase to $50 billion in 2025, which could justify a valuation of $100 billion at a 2x income several. Increase a minimal for the Vitality business, and GE could be truly worth something like $110 four yrs from now. Relative to the present-day valuation of a tiny a lot more than $80 billion, that could make for a 30% achieve, which would not be a terrible return. But considering that there is pretty much no dividend generate, overall returns would not be terrific, both.

Analysts are now predicting earnings per share of $7.80 for fiscal 2025, despite the fact that there are key unknowns listed here of course, as we do not know yet what the margin advancement initiatives and buybacks will end result in above the up coming pair of a long time. If just one ended up to put a 15x earnings several on that range, a single could get to an upside of extra than 50% above the future four decades. But because of to GE’s checkered previous and its recurring underperformance relative to enterprise plans and analyst estimates, I do believe that the EPS estimate could possibly be way too aggressive. If precise success are weaker, complete returns in a natural way would be weaker as well.

Even now, it looks rather probably that GE will see its shares climb above the subsequent few of decades, as the spin-offs ought to unlock worth and considering that the financial debt reduction efforts in modern a long time could outcome in much more FCF remaining out there for shareholder returns and other steps.

Is GE Inventory A Obtain, Market, Or Hold?

If a person purchases GE today, I do believe that that there is a high chance of positive returns more than the up coming pair of yrs. GE Aviation and GE Health care are interesting firms with a strong very long-expression outlook. That currently being said, GE is not the most eye-catching industrial organization in the entire world, e.g. due to its missing dividend produce and its unconvincing track document. I consequently do consider that GE is a reasonable hold but personally do not search for to get shares at recent prices.

[ad_2]

Resource link

More Stories

The Best Beautiful Places to Visit in Nepal

Quality Printing with Cartridge Packaging

Republican nominee for Maryland attorney general hosted 9/11 conspiracy radio shows